UTEX now alerts users to price changes

This will help both beginners and advanced users to avoid unprofitable deals.

We take care of our clients so we made some prompts for the trading screen in UTEX. This will help both beginners and advanced users to avoid unprofitable deals.

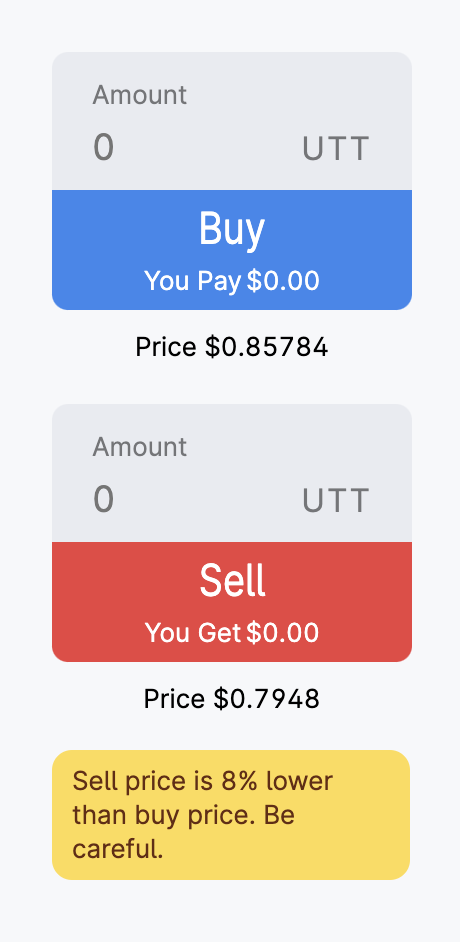

Large spread

Now the basic trading interface will show a prompt alerting a user to a high (more than 3%) difference between the buying price and the selling price due to low liquidity. The prompt stays put until the spread falls back within its normal range.

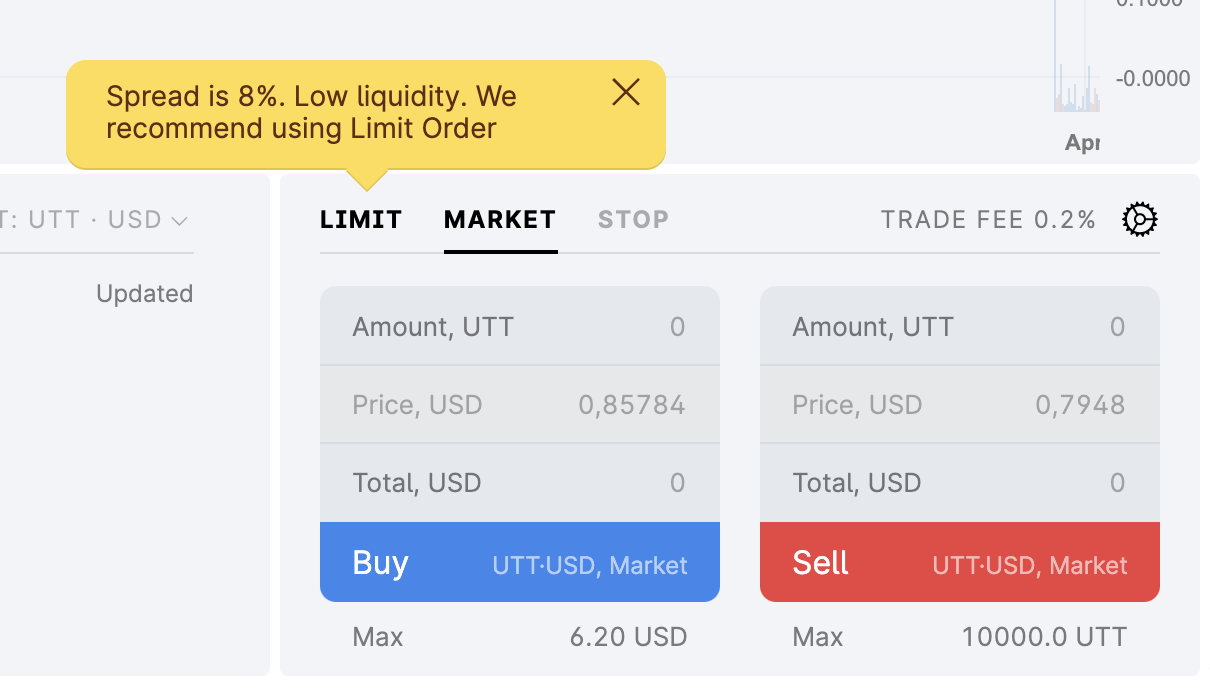

If you use a PRO-interface, you will encounter an analogous prompt in several places. You will see it in the DOM:

It also pops up when you move to the tab with market orders:

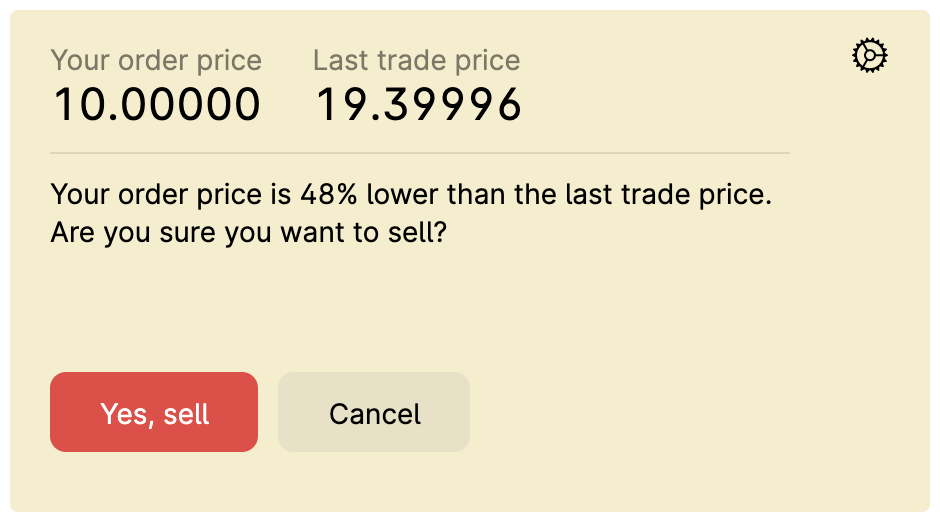

Breakouts

In the PRO interface, when you place a market order in a trading pair with low liquidity, the system will automatically calculate the "effective spread": the weighted average price of a trade by factoring in what price levels in the market book can be broken by user's order.

If the calculated value is higher than the nearest available buying price (if that’s a sell order) or selling price (if that’s a buy order), a warning message will appear.

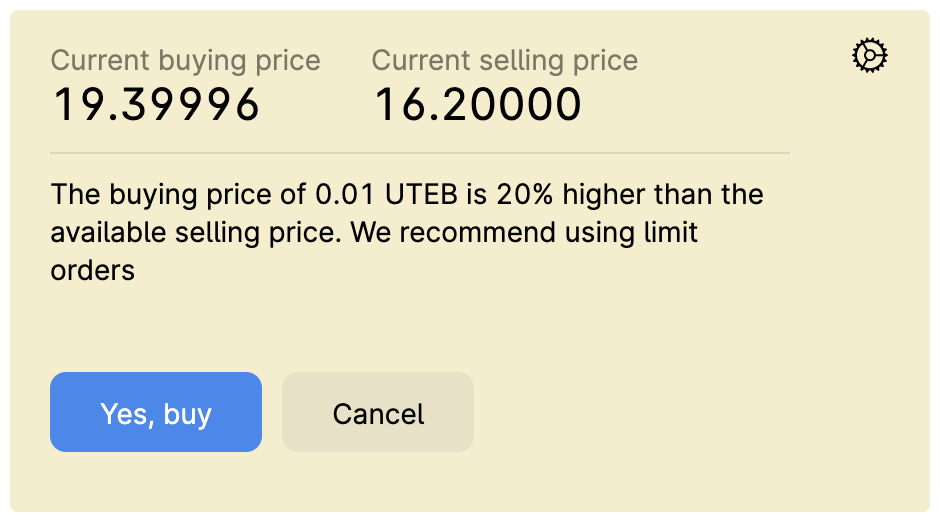

Limit orders

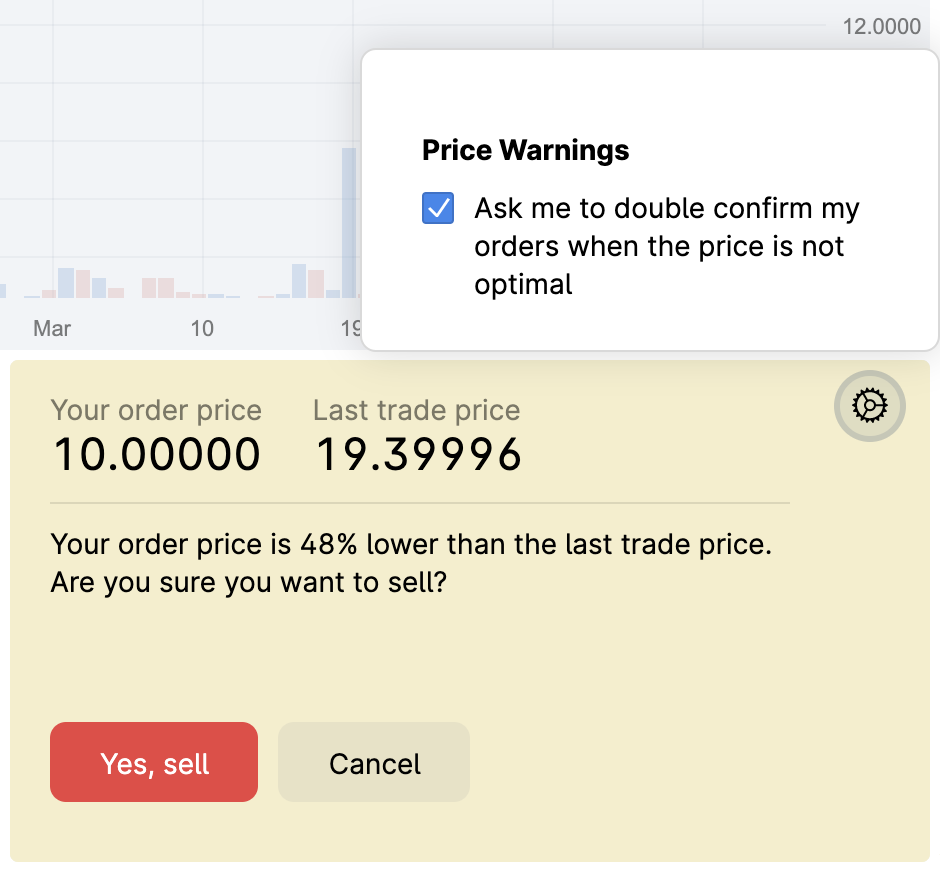

If the price indicated in the buy order significantly exceeds last trade’s price, an additional warning window will appear before the order is placed. It will show how big the difference between the two prices is.

Disabling prompts

You can’t disable the large spread prompts in the basic trading interface, but it is possible to do so in the professional version. To disable prompts or enable them again, click the gear icon in the trading block:

***

We introduced these prompts so that any UTEX user could be alerted to a large spread and can therefore consider this risk when making his or her trades.