Investment results for the 2nd quarter of 2021

Pre-IPO market growth, new funding records and 250 new unicorns

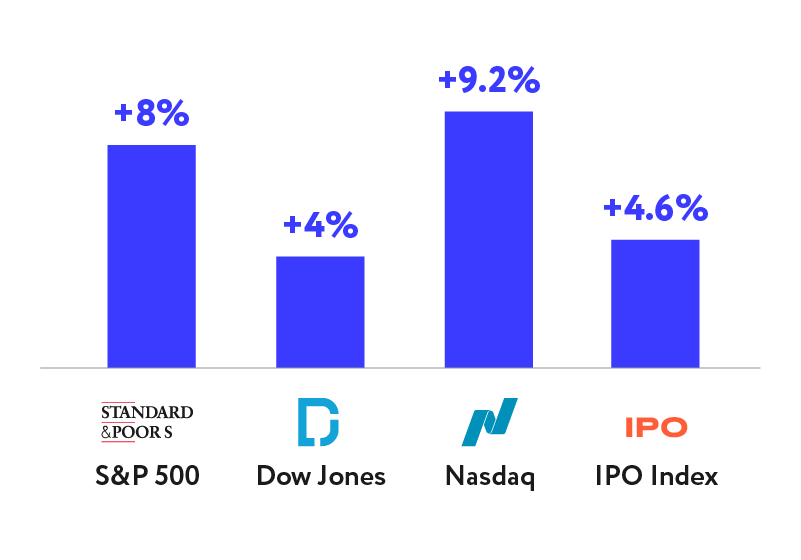

The yield of the US stock market indices in the 2nd quarter of 2021:

In the first half of 2021, the broad S&P 500 US market index and the NASDAQ technology sector index increased by 15% and 12%, respectively. The energy and banking sectors demonstrated outstripping growth rates. The technology sector showed moderate growth, whereas biotech companies were among the outsiders.

Despite the general bullish trend in the market, investors are still scared of rapid inflation growth — it has significantly exceeded the 2% target set by the Federal Reserve System. In May, the consumer price index rose by 5% compared to May last year — it's the maximum value since the global financial crisis of 2008. Nevertheless, the Federal Reserve claims that higher inflation will be a temporary phenomenon. The recovery of real economy and the labor market remains far from complete, and the key rate will not be raised until at least 2023.

IPO

Many private companies perceived the high market liquidity as the right time for an IPO. So, since the beginning of 2021, during the IPO, the companies have raised more than $171 billion — this already exceeds the total in 2020 ($168 billion). The popularity of SPAC companies' stocks has significantly decreased. In the first quarter, blank check (SPAC) companies accounted for over half of all IPOs, whereas in the second quarter their percentage dropped to only 13%. We expect that SPAC transactions will again spark investors' interest in the second half of 2021.

In the second quarter of 2021, we participated in the IPO of nineteen companies; most of them had a successful IPO experience and felt confident in the market. The growth leaders include the biotech company Recursion Pharmaceuticals (+104%), the Israeli e-commerce company Global-E Online (+117%), the service for healthcare professionals Doximity (+92%) and autonomous-truck developer TuSimple (+56%). Other noteworthy IPOs include DoubleVerify (+46%), Monday.com (+48%), TaskUs (+41%) and the recent listing of the next-generation cybersecurity platform SentinelOne (+30%). At the end of the 2nd quarter, the average current IPO commission-free return on investment is +33%.

Pre-IPO

Against the background of high technology public companies' volatility, the private market looks confident and keeps offering interesting opportunities for investors. According to Ernst & Young, in the first half of 2021, American private companies raised a record $140 billion in funds. This makes 91% of $153 billion collected in 2020 in total.

In the first six months of 2021, 250 companies became unicorns: they has new funding rounds, valued at more than $1 billion. This is an absolute record in history.

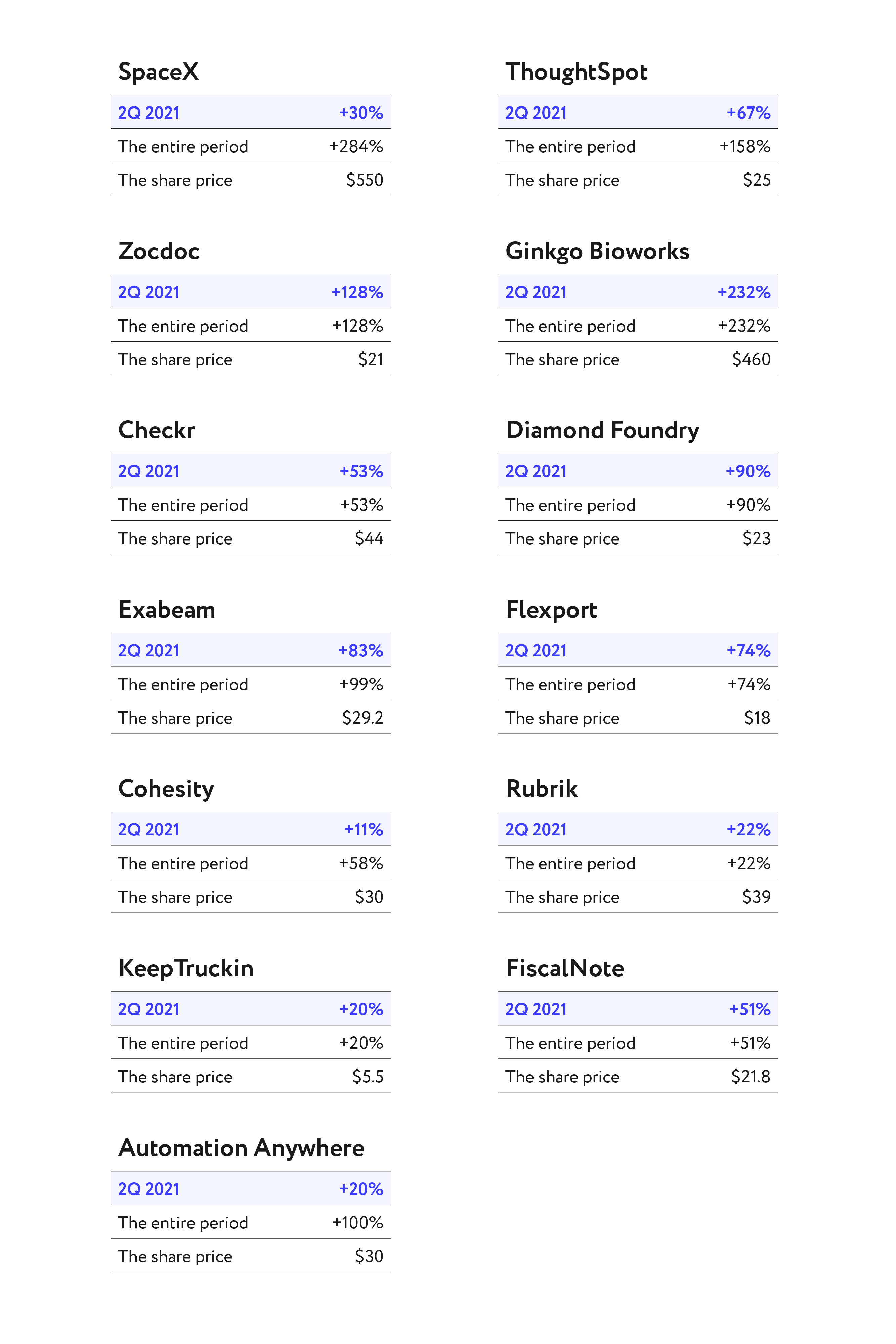

Our portfolio companies have also been through many positive corporate events. As a result, the shares of thirteen companies traded on the unitedtraders.com platform , have increased in price*.

*Prices are as of June 30, 2021

Also this quarter we closed the investment in Airbnb — one of the first private companies that we offered at the pre-IPO stage. The commission-free return on investment was 139%.

New investment ideas

Last quarter, we added new private companies to our portfolio that are prospective disruptors in the associated fields. These are the global payment system Klarna, the Kraken crypto exchange, the medical drone delivery giant Zipline, the producer of "test tube" eggs and meat Eat Just, the developer of ultra-fast charging batteries StoreDot and the Trax Retail company that applies artificial intelligence technologies in retail.